Menu

Simply because they usually only provide at 70 so you can 80 percent mortgage-to-value rates, he has an excellent 20 so you can 30 % support to guard all of them whether they have so you're able to foreclose. They often always pick during the foreclosures revenue and pay-off your debt and sell our house having a profit.

I'd yield to your you never need trust me personally, however, which denial, the new justification they normally use because of it was high-risk. Therefore this is actually the question. In the event the chance is really large, up coming loss have to be high, but let's go through the winnings the businesses make. That's not what we try watching. The earnings is actually tremendous.

Well the latest National Financial News merely points out into the a blog post they are going to get reduce Places Credit, however towards the cause I'd has hoped, but, because they only acquired $5 mil thirty day period. https://cashadvanceamerica.net/payday-loans-ri/ They'll remain Equicredit while they secure $31 billion 1 month. We submit to your again that payouts are perfect.

The following factor, these businesses perpetrate abusive means. We refer to them as the brand new substantive abuses and i also enjoys place all of them out in my personal written testimony and also in an appendix. You've got read the latest litany of one's abuses.

We submit to your that individuals must know a very bottom line. This type of abusive practices, the fresh substantive punishment, differs from attract and value and generally are inextricably connected having earnings. These companies do not perform these items since they are suggest, and you may believe me he could be indicate. They actually do these things because they enhance winnings.

After you pack borrowing from the bank insurance policies when you look at the and also you very own the insurance coverage part, you are improving payouts. As soon as youre inquiring these businesses to stop the newest abuses and you're seeking to legislate and you will control the latest abuses out, they are not attending should do you to definitely.

Whenever Fannie and you can Freddie will likely be to shop for this type of loans, Fannie and you will Freddie aren't planning need it financing that don't possess these abuses i do believe, because they are very effective.

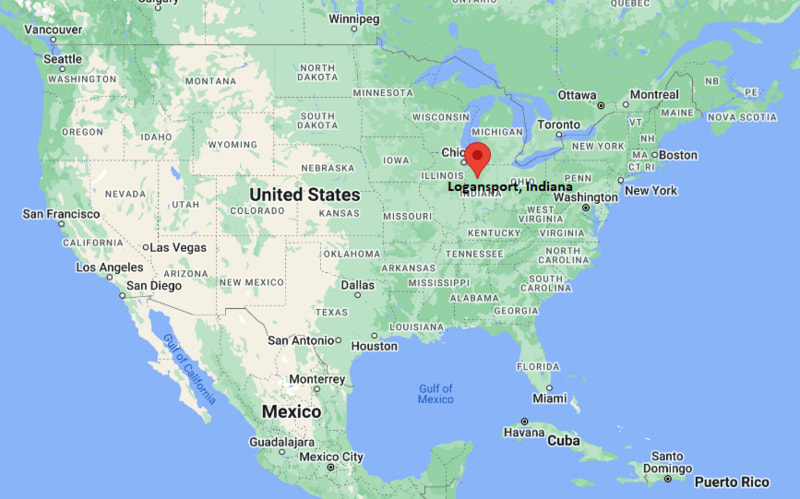

These businesses target communities centered on many years, battle and you may sex. We observe that all the time. I've a map as well I will make suggestions. John's chart is alright there are so many a great maps. The newest NTIC somebody did an effective map, the fresh Woodstock Institute has revealed that prime financing have white communities as well as the subprimes are located in fraction communities. In my opinion its unquestioned now.

We notice it day-after-day. My regular consumer try an elderly, African-Western widow. You will find document compartments full of this type of instances. I believe they are doing it for causes that produce feel to them. They target seniors as they keeps repaid its mortgage loans by the staying in their houses lengthy and they have resigned, so that they try cash-terrible and you will collateral-rich. They are prime aim towards the subprime lenders.

It address fraction communities because they has actually typically started cut right out off use of credit and these lenders know that. Even when having increased, lenders see all of these people do not understand they may get access to a good credit score.

I do believe it target insecure feminine also. I don't know precisely why. Really don't should make one sexist statements, however, perhaps instance specific old ladies who features depended greatly on the their husbands to assist them to that have economic activities and are now widows, eg. I am not sure as to why precisely, but a lot of off my clients are female.