Menu

Improving your credit history demands a combination of an excellent economic habits, perseverance, and you will an understanding of just how borrowing works. Following such measures, you could potentially increase creditworthiness and you will status on your own getting an even more beneficial financial. Think of, increased credit score can cause ideal rates of interest and you will conditions, sooner and make your perfect house more affordable.

Getting the best tools and info at your disposal makes a positive change from inside the efficiently keeping track of and you will boosting your credit score. Right here, you can expect an effective curated set of of use tools and how to utilize them for the best, guaranteeing you are really-willing to safe a home loan into the greatest conditions.

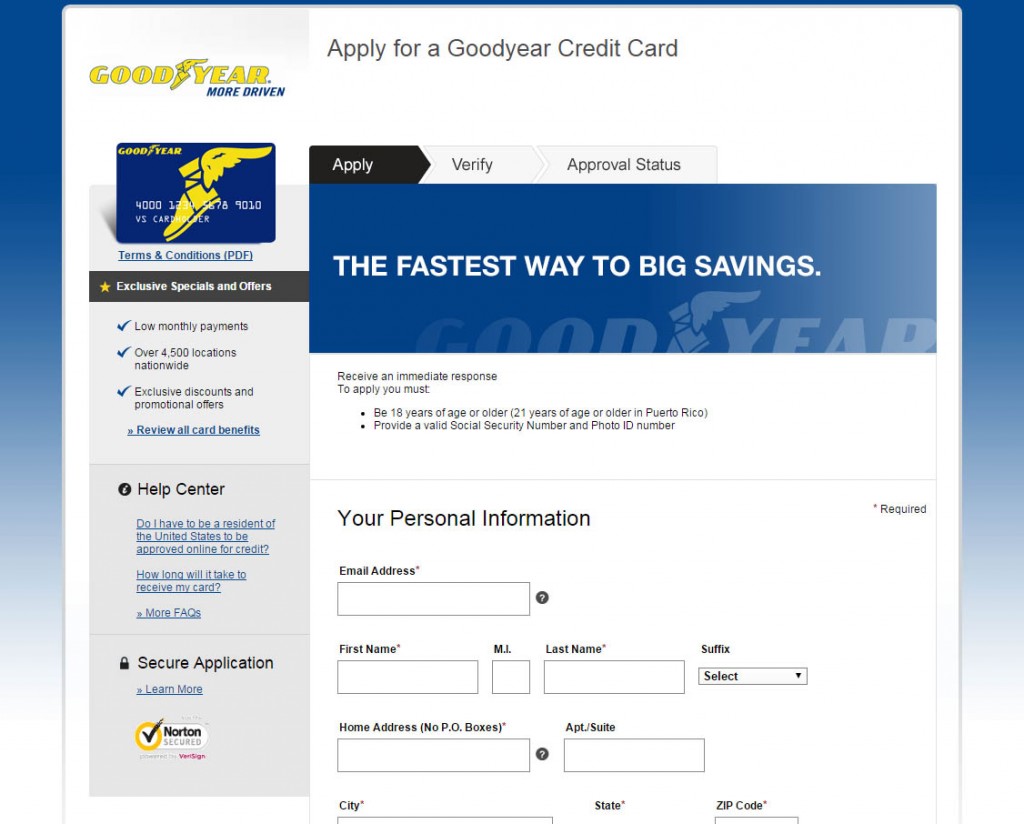

Credit monitoring features was invaluable partners whenever maintaining and you may improving your credit history, specially when you might be eyeing a home loan. These types of services are experts in keeping track of your credit score and rating, getting prompt notification on one the new inquiries, account alter, otherwise signs of potential swindle. It proactive keeping track of is vital in the current digital many years, where identity theft and you will credit scam is prevalent issues.

The great benefits of signing up for a credit keeping track of provider try manifold. Firstly, they give normal condition on your own credit history, letting you understand the feeling of your own monetary behavior when you look at the live. Whether or not paying personal debt or correcting mistakes on your statement, you will find just how these types of actions dictate your own get. This continuous viewpoints try instrumental into the guiding your time and efforts to change otherwise look after a good credit score, a switch cause of securing beneficial mortgage terms.

With regards to going for a credit monitoring provider, there are a few credible solutions. Services such as for example Credit Karma are notable for their comprehensive monitoring prospective. It track changes in your credit score and gives expertise and you will advice on managing your own borrowing better. By leveraging these tools, you could potentially remain to come on the borrowing government video game, ensuring you're usually advised plus command over your financial health, paving just how for a smoother financial software processes.

Financial believe programs are very essential tools to have finding and you will maintaining the healthy credit history important for protecting a home loan. These types of applications are made to promote an extensive service to own managing individuals aspects of your bank account, nearby debts, expenditures, and you will funds think. These types of programs is actually pivotal in empowering you to definitely make advised financial decisions by offering an integral view of your financial condition.

One of the many benefits of using economic considered software try their ability to remain on best of the finances. Which vigilance is particularly essential when handling credit usage and you will maintaining an optimistic commission background, one another key factors within the choosing your credit score. For instance, by the overseeing your spending and you will personal debt levels, this type of software can assist you in keeping their credit use proportion for the demanded assortment.