Menu

Homeownership has a low profile benefits called domestic collateral, so if you're a home-working citizen, you're curious just how to influence and check your residence equity in order to influence it for your monetary needs. In this article, we shall delve into all you have to realize about home guarantee money, with a certain work on lender statement home equity fund and you may credit lines (HELOCs) you to definitely focus on notice-working someone.

In advance of examining financial statement domestic guarantee money and you may HELOCs, let's earliest know how to influence your residence guarantee. Domestic guarantee is the difference between the present day market value away from your home plus the the balance on the home loan. So you can determine they, you should use the second formula:

Your residence's worth should be calculated as a result of a specialist appraisal otherwise by researching current possessions transformation close by. Your own financial equilibrium can be obtained on your own financial report.

Household guarantee loans, known as 2nd mortgages, create residents so you're able to borrow secured on the latest guarantee they've got manufactured in their house. Here are a few tips to adopt:

An effective HELOC is another selection for opening your residence's guarantee. In lieu of property collateral mortgage, which provides a lump sum, a great HELOC really works similar to a charge card, allowing you to borrow cash as required doing a fixed borrowing limit. Here's what you must know:

When deciding ranging from a financial report family security loan and you may a great HELOC, consider carefully your payday loans Ault financial needs and you may choices. Domestic guarantee financing are right for individuals who favor fixed money and you may a lump-sum payment, if you are HELOCs offer freedom that have adjustable prices and ongoing the means to access loans.

If you are wondering whether you could potentially safer a mortgage otherwise a beneficial second financial in just financial comments, the solution try yes, nonetheless it utilizes the financial institution. Certain lenders bring lender declaration-just mortgage loans, which can be available for care about-employed people that might not have traditional earnings records. Such fund consider carefully your financial statements while the evidence of income.

While you are mind-operating and applying for make use of their residence's security, it's also possible to currently understand challenges awaiting your when trying sign up for a home loan. If you have loads of equity but do not have to compromise your existing low interest financial, there had been couples, or no, available options until recently.

We offer a Lender Declaration Next Financial that allows business owners to get a fixed-rate second mortgage using bank statements to qualify, instead of tax returns.

Lender Statement Next Mortgage loans, should be an enthusiastic valuable product to possess mind-operating people trying to unlock its home's equity without sacrificing the new low interest on the present first mortgage. This choice also provides autonomy, accessibility, and you may stability, to make dollars-away much more achievable of these having low-traditional income source. However, it's necessary to meticulously comment brand new terms, rates, and you may eligibility requirements to see if this is basically the better fit for your financial requirements.

To conclude, information your residence security therefore the possibilities, such lender statement home security money and you can HELOCs, can be enable you to generate informed economic decisions. Whether you are combining financial obligation, investing a home, and also make home improvements, purchasing an automobile, otherwise resource knowledge, your own residence's security might be a valuable financial support on your economic trip.

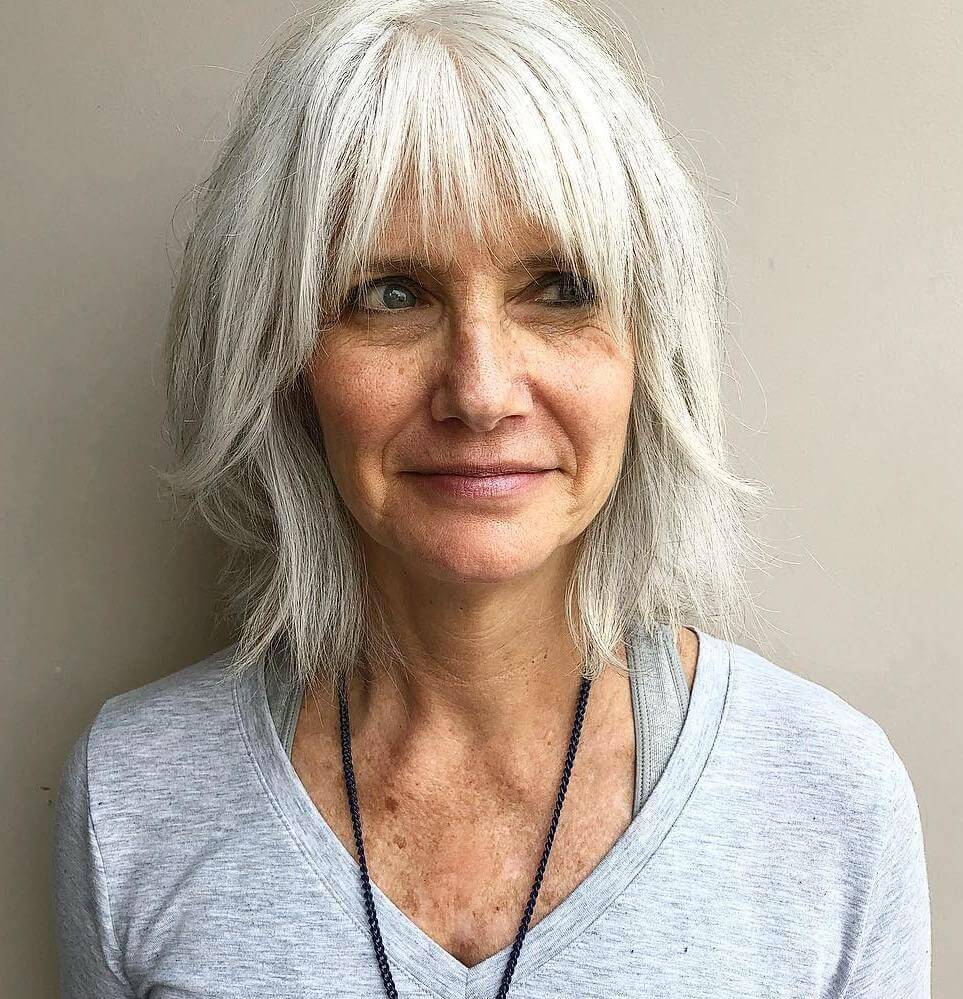

Derek Bissen try an authorized Real estate loan Inventor with over 25 numerous years of knowledge of the industry. Derek is a personal-functioning credit professional who's noted for his ability to performs that have borrowers with good-sized money and non-antique lending requires. They are an innovative mortgage structurer and you can specializes in collection credit, asset-founded lending, financial declaration credit, and additionally conventional financing eg Traditional, FHA, Virtual assistant, and you may basic-time homebuyers.

Derek's expertise in the loan industry is unparalleled. He is a trusted mentor so you're able to his website subscribers, providing them with customized mortgage choices one to see her economic goals and requires. Their vast knowledge and experience generate him a valuable asset to some one looking to buy property otherwise refinance their established mortgage.

As the an incredibly-educated mortgage founder and you will blogger, Derek was dedicated to sharing his knowledge with people. He continuously brings valuable facts and you can guidance to help you subscribers seeking navigate this new advanced field of financial lending. His articles are informative, enjoyable, and you can backed by several years of hands-on experience.

Together with useful training and you may commitment to his website subscribers, he is the fresh new wade-so you can origin for all mortgage financing means. If you're looking to have a reliable and trustworthy financial pro, get in touch with Derek right now to find out about just how he can assist you accomplish your financial goals.